Wow still not used to typing “2026” even this late into the year. Anyways, everybody else is doing predictions, why not us? Let’s get started. The economy will finally break down Trump does seem to have the ability to escape gravity time and time again, but can number go up forever, despite him doing everything in his power to make number go down? The only thing anybody cares about is rising prices, and all he has done has been to make prices go further up. Despite what he says, consumers pay tariffs. Overwhelming immigration raids make construction...

Continue reading...Money and the Economy

Killing Lincoln

Today is the last day the penny will be in production in the United States. It will probably go out unnoticed for the most part, as durable as the reddish currency has been for centuries. Made now out of just a speck of copper (mostly zinc), it’s apparently more expensive to make than it holds as currency, so some people say it shouldn’t be minted anymore. Not a terribly good reason (currency doesn’t hold value as the value of itself), but pennies are pretty worthless nowadays so there are only a couple of reasons why not to...

Continue reading...Thank you, Thank you, and Childcare

I remember when Mike Tyson was set to take on Evander Holyfield, when the first iphone was advertised, and when the Era tour tickets were scheduled to go on sale. So, I’m not going to pretend like my return to the blog-o-sphere is not soaked with anticipation. What’s he been up to? Has he written under a different name? What has he been drinking? The answer is making charts, no, and check out this beer-score chart. Here is the science to back it up: But what I would like to discuss today is childcare. Other countries do it...

Continue reading...The answer—as always—is more ads

I’m sitting here watching the Gotham FC-Kansas City Current match on CBS. KC really came out early and smashed Gotham with two goals in the first 13′, so it’s not that interesting of a match at this point**. It’s nice that NWSL matches are being aired on broadcast television. However, CBS (and some other broadcasters but this post is about CBS) has started placing ads during the game. Sure, it’s usually during short breaks like substitutions or injuries, but they did cut to a commercial when there was no break, but I assume the producers had expected...

Continue reading...Breakfast Octopus

Go ahead and read these two paragraphs (go ahead, I’ll wait for you): So there sat Bezos at the breakfast table, faced with a question for which he was apparently unprepared. Many painful seconds passed without an answer. Rutledge let the pause lengthen as long as he could bear it and was just about to tell his host to forget it, when Bezos finally spoke. He looked down at his plate. Bezos had ordered a dish called Tom’s Big Breakfast, a preparation of Mediterranean octopus that includes potatoes, bacon, green garlic yogurt, and a poached egg. “You’re...

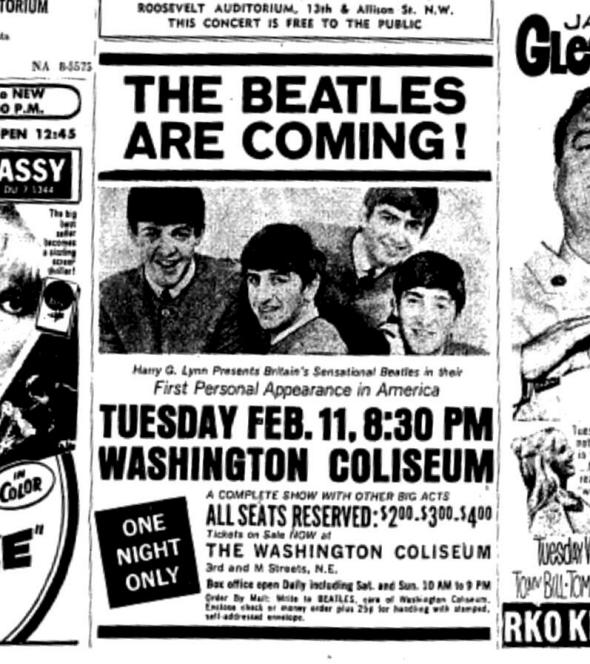

Continue reading...Why those Beatles tickets were reasonably priced

Yglesias notes that when The Beatles came to town in 1964, tickets to see them were actually pretty reasonable, if not downright cheap: Adjusting for inflation, those tickets ranged in price from $15 to $30. These days $30 will get you in to see St. Vincent at the 9:30 Club but prices to see Kings of Leon at the Verizon Center start at about $60. There are a number of concomitant reasons why, despite it being the hottest show in the world, it was so much cheaper than any popular concert would be in 2014. First is the simplest of...

Continue reading...Economic inequality and mobility are not the same thing

It’s the story of the day. Well, it’s the story of the past, well, ever. It seems the rich get richer and the poor get poorer and the middle gets squeezed. And, truly that’s at least been the case since 1980. Some see the cure for this malady to be “economic mobility,” which basically means, making it easier for people who were born poor to stop being so poor and start being middle class (or rich even!). Hard work and smarts! The American dream! It’s the obsession of Americans, this idea that there’s a path for people...

Continue reading...Ninety percent of fast food cooks will be affected by D.C. raising the minimum wage

D.C. recently passed a law gradually increasing the minimum wage, from $8.25 to $11.50 by 2016. According to a report by the D.C. Fiscal Policy Institute, this will affect ninety percent of D.C. fast-food cooks. I don’t have much more to say about that, except it’s a damned shame we have to have this job-killing minimum wage, because corporations would be paying workers way better without it. Or something. Unleash the free market or whatnot.

Continue reading...Moody's "double agent" ratings: How the game is rigged

RJ Eskow: Despite all the evidence, Moody’s is still treated as a credible player … and one that’s powerful enough to send a warning shot across the bow of the United States government. It threatened to downgrade the US government’s debt last March if more wasn’t done to reduce the government’s debt. That’s the kind of rigged game we’re facing: One of the biggest sources of the government’s debt is the economic collapse. That collapse was enabled in large measure by the bad ratings issuing by rating franchises like Moody’s. Now Moody’s wants to hamstring the government’s...

Continue reading...Fed keeps on keepin' on

The Federal Reserve’s Open Market Committee met today, and it seems they’re keepin’ on keepin’ on. At least according to their release: The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period. The Committee also will maintain its existing policy of reinvesting principal payments from its securities holdings. Now, this is despite recognizing that...

Continue reading...

Recent Comments